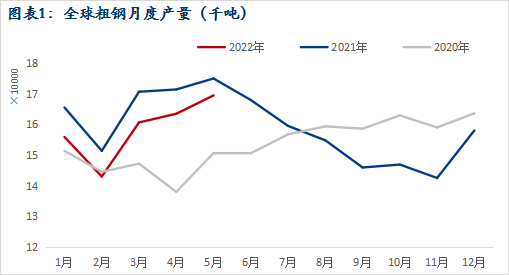

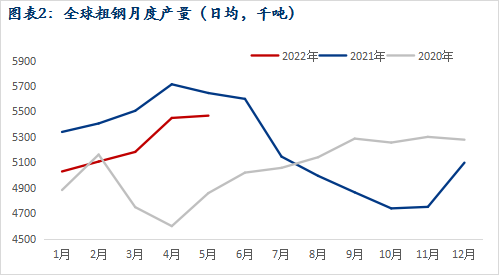

According to the World Steel Association (WSA) data on June 23, the crude steel output of the world’s 60 major steel-producing countries in May 2022 was 16,950 tons, a month-on-month increase of 3.7% and a year-on-year decrease of 3.5% in May last year. From January to May, the cumulative global crude steel output was 792.4 million tons, down 5.09% from the same period last year. Chart 1 and Chart 2 show the monthly trend of global crude steel production in March.

In terms of average daily output, China’s month-on-month growth has narrowed significantly, from 8.6% in April to 0.8%. The overall output of Asian countries increased steadily, while the output in Europe increased slightly except for Germany, which decreased month-on-month. The country with the largest decline was Turkey, whose daily production fell by 7.7% month-on-month.

| 图表3:2022年5月全球TOP10产钢国粗钢产量(万吨) | ||||

| 国家 | 2021年4月 | 环比 | 同比 | |

| 1 | 中国 | 9661 | 4.1% | -3.5% |

| 2 | 印度 | 1062.4 | 3.0% | 17.3% |

| 3 | 日本 | 806.5 | 8.0% | -4.2% |

| 4 | 美国 | 717.8 | 3.3% | -2.6% |

| 5 | 俄罗斯 | 640 | 1.6% | -1.4% |

| 6 | 韩国 | 579.7 | 5.2% | -1.4% |

| 7 | 德国 | 324.2 | -2.5% | -11.4% |

| 8 | 土耳其 | 321.4 | -4.6% | -1.4% |

| 9 | 巴西 | 297.2 | 1.7% | -4.9% |

| 10 | 伊朗 | 230 | 3.4% | -17.6% |

| 全球 | 16948.3 | 3.7% | -3.5% | |

| 全球除中国 | 7287.3 | 3.1% | -3.5% | |

| 来源:worldsteel | ||||

| 图表4:2022年5越全球TOP10产钢国日均产量(万吨) | ||||

| 国家 | 2021年5月 | 环比 | 同比 | |

| 1 | 中国 | 311.6 | 0.8% | -3.5% |

| 2 | 印度 | 34.3 | -0.3% | 17.3% |

| 3 | 日本 | 26.0 | 4.5% | -4.2% |

| 4 | 美国 | 23.2 | -0.1% | -2.6% |

| 5 | 俄罗斯 | 20.6 | -1.7% | -1.4% |

| 6 | 韩国 | 18.7 | 1.8% | -1.4% |

| 7 | 德国 | 10.5 | -5.6% | -11.4% |

| 8 | 土耳其 | 10.4 | -7.7% | -1.4% |

| 9 | 巴西 | 9.6 | -1.6% | -4.9% |

| 10 | 伊朗 | 7.4 | 0.0% | -17.6% |

| 全球 | 546.7 | 0.3% | -3.5% | |

| 全球除中国 | 235.1 | -0.2% | -3.5% | |

| 来源:worldsteel | ||||

In May, China’s crude steel production continued to hit a new high for the year, reaching an average of 3.1165 million tons per day, but a year-on-year decrease of 3.5%. From January to May, China’s crude steel output reached 435.65 million tons, down 8.7% year-on-year. The figure of the Chinese Bureau of Statistics is 435.02 million tons. The crude steel output of various provinces and cities in China refers to the “Statistics Bureau: The crude steel output of various provinces and cities nationwide in the first five months was released, and Hebei fell by 12.11%”. After entering June, domestic steel prices have fallen sharply, and the scope of production reductions in both long and short processes has expanded. According to Mysteel research, due to widespread losses in steel mills, during the period from June 15 to 21, a total of 21 blast furnaces were under inspection, There are 11 electric furnaces under inspection and 14 tie lines under inspection. For details, please refer to “Summary of Production Reduction and Maintenance Information of National Steel Plants on June 23″

The output of crude steel in India has dropped significantly in April, and the daily average output continued to decline in May. However, the cumulative output from January to May increased by 9% over the same period last year to 47.54 million tons. After the Russian-Ukrainian conflict broke out in late February, India quickly served as the main substitute country to supplement the demand for European flat products. This favorable situation promoted the enthusiasm of Indian steel companies to increase production, but what followed was the need for the local government to restrain inflation and adopt export-restraining tariff policies. . Indian steelmakers are struggling to maintain exports by adding alloys and lowering domestic selling prices to maintain market share in Europe, but this will inevitably lead to further reductions in production pace for steelmakers as domestic demand remains sluggish.

In May, the 27 EU countries produced 12.923 million tons of crude steel, with an average daily output of 431,000 tons, a month-on-month increase of 2.57%. However, the average daily output of crude steel in Germany, the most important crude steel producer in the EU, decreased by 5.6% month-on-month in May, while the crude steel output of many European countries such as Italy, France, Poland, Austria and Belgium showed a slight recovery. Because German traders accumulated a lot of inventory in April, they were in the destocking stage in May and June, and the downstream demand was not good, and the market oversupply was common. Major German long product producers Badische Stahlwerke and Lech Stahlwerke announced at the end of April that they would suspend production of their 1m t/y electric arc furnaces due to high energy costs. In June, more large steel mills in Europe chose to reduce production due to cost issues, including ArcelorMittal’s closure of the 1.2 million t/a blast furnace in Dunkirk, France, and the blast furnace at the Eisenhutenstadt plant in Germany. Steel companies will finalize long-term contracts in the third and second quarters of this year by the end of June, and European steel production in June is likely to decline compared to May.

From January to may, Ukraine produced 4.24 million tons of crude steel, a year-on-year decrease of 52.8%. In May, the output rose slightly, but the range was small. In addition, pig iron production decreased by 53.5% to 4.15 million tons. This has reduced Ukraine’s crude steel output from the 13th place last year to the 18th place in the world. Before the conflict between Russia and Ukraine, the steel industry was the largest source of export revenue in Ukraine. At present, the capacity of steel mills in eastern Ukraine has been damaged, and there is little hope of short-term production recovery. In June, some major factories began to operate again, including aporizhstal, ArcelorMittal kryvyi RIH, etc. However, due to the relatively single products, some products still need to be imported. It is expected that crude steel output will continue to rise in June, with a growth rate greater than that in May.

The continuous conflict between Russia and Ukraine has not affected the pace of Russian steel production, and its crude steel output remained stable in April and may. In May, Russia produced 6.4 million tons of crude steel, an increase of 1.6% month on month, and the daily average output decreased by 1.7% month on month. In fact, although Russia adjusted its export strategy and led the sharp decline in the Asian market, its total export volume was still affected to some extent. A spokesman for nlmk, one of the largest steel companies in Russia, has said that steel exports are expected to decrease by 23% in 2022, because there are other obstacles to its sales in Asia, especially finished steel. Therefore, in the future, the export sales of semi-finished products will be mainly used to slow down the decline of domestic demand, while steel production will strive to maintain the current level to stabilize the normal operation of domestic enterprises.

Due to the unsatisfactory demand for downstream steel and the high inflation level, the United States has entered the interest rate increase cycle in May, but the steel productivity is still at a high level. The crude steel output increased by 3.3% to 7.178 million tons month on month, and the daily average output decreased slightly by 0.1% month on month. At present, the weekly capacity utilization rate is still at a high level of more than 80%, and the overall level in June is even higher than that of the same period last year, although its steel price is almost halved compared with the same period last year. The main reason is that American steel enterprises still enjoy a higher profit level than steel mills in other countries in the world, and the coil waste difference remains above 700 US dollars / ton. Therefore, in the short term, the willingness of American steel mills to reduce production will not be very high.

In May, Turkey’s crude steel output fell by the most in the world, with the daily average output falling by 7.7% to 104000 tons month on month. In April, Turkey’s screw waste difference continued to rise, but in early May, it experienced a rapid contraction, which to some extent suppressed the production enthusiasm of Turkish steel producers dominated by electric arc furnaces. In June, the price of scrap steel in Turkey continued to fall in a wide range, once again opening the screw scrap gap. However, the global steel prices have fallen continuously, the market sentiment is slightly pessimistic, and the Turkish factories may increase production slightly, but the range will not be very large.

Post time: Jun-28-2022